mypath mymoney

Our Next Generation Fintech Platform

MyPath MyMoney is a dynamic, interactive financial capability hub for youth participants, alumni, and staff at our partner organizations built with input from impacted young people, practitioners and leaders from the financial capability field. Providing continuous access to financial education, tools, and resources, MyPath MyMoney is a growing ecosystem that meets diverse needs of youth and partners in one place.

Round-the-clock, trusted information and resources to help young people make informed financial decisions.

FOR YOUTH

We consulted with youth across the country to ensure that MyPath MyMoney provides the tools and resources that are relevant to youth’s evolving financial needs as they move through the decade of financial firsts:

- Savings, credit and money management modules

- Credit scores and reports

- Youth-friendly financial products

- Connections to Financial Mentors

FOR PARTNERS

MyPath MyMoney offers partners comprehensive support to confidently and successfully integrate MyPath’s financial capability models into their youth-serving programs:

- Customized content to onboard and train staff and youth

- Resources to support organizations’ adoption of financial capability practices and policies

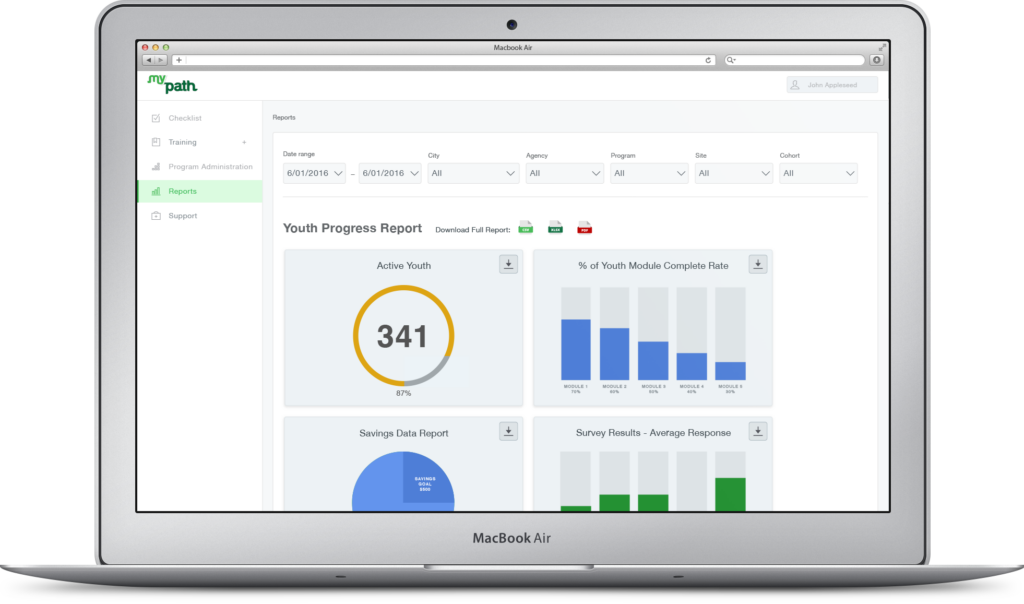

- Improved data collection and evaluation tools to monitor youth progression and programmatic impact

MOBILIZING COMMUNITIES TO DRIVE POLICY REFORM

MyPath MyMoney connects partners and young people across the country to create a national network of advocates who will use their voices to drive systemic change and advance MyPath’s Youth Economic Bill of RYTS. Through facilitated conversations on financial inclusion, surveys, and insights from partners and youth, MyPath MyMoney captures youth’s powerful lived experiences to activate stakeholders and drive advocacy campaigns and policy reform.

“MyPath brings a mindfulness to what your expenses are. And it goes along with how our program is run in that we create individual goals with them (the students). It provides a platform for them to set what goal they have in mind, like a down payment for a car, and really analyze what they’re spending their money on, and being able to see the big picture of it.”

-Rachel Harris, CDSA YouthBuild Director

Enid, Oklahoma